Every organization is responsible for managing the payroll of its employees and contract workers: tracking and reporting each employee’s wages, bonuses, and all deductions, as well as active support for the workers during the length of their assignment. And depending on the jurisdiction of where the company operates, there can be upwards of 20 different employment records to manage and comply with government regulations.

No matter the size of an organization, contract workforce payroll administration is a complex and time-consuming process involving many departments. Companies may choose to run their contingent worker contracting and payroll functions internally, with responsibility spread out over a variety of departments, from HR, to procurement and accounting/AP, but that isn’t always the most efficient way to go. Staying on top of the frequent changes to legislation can be problematic, and any oversights can result in non-compliance, which could lead to serious fines and reputational damage.

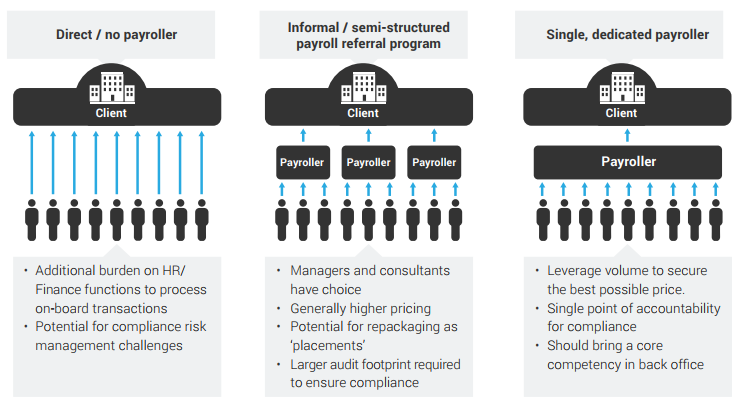

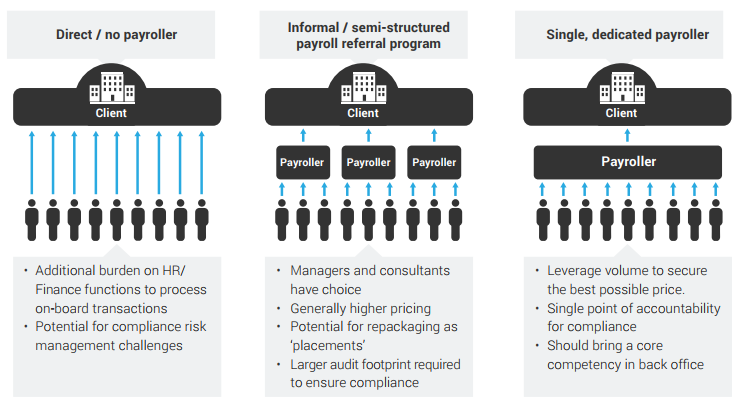

As organizations grow, and become more focused on compliance and spend management for their contingent workforce, they will typically shift from a ‘direct contractor payrolling model’ to a third-party payrolling model, either built around the selection of a dedicated supplier or through informal referrals to a variety of suppliers.

Direct/No Payroller

This model involves the client company directly handling all aspects of the contractor engagement, onboarding and payment duties. Responsibilities are often spread across a variety of functional areas, ranging from human resources to procurement, contracting and accounting, and coordination responsibilities often are placed on the individual hiring manager that is sponsoring the engagement of a particular contingent worker.

The company is responsible for managing all aspects of the payroll process, including the administration of tax and benefits forms, payroll deductions and submission to government agencies. This approach is often used by companies that prefer to manage the payroll process internally due to perceived cost savings over hiring an outsourced provider, or there is no structure in place to help manage contingent workforce costs, and address compliance or risk management issues specific to these types of workers.

There is a higher level of risk with this model since employee/contractor regulations and categorizations may change frequently. It can be difficult for busy HR personnel to stay up-to-date with current laws, particularly for companies with operations in multiple jurisdictions or those who employ exempt/non-exempt, seasonal, contract or part-time workers. Government non-compliance fines can be significant and unforgiving.

Informal/Semi-structured Payroll Referral Program

This model is often not an ‘official’ company mandate – instead it usually involves individual hiring managers referring the favoured contingent worker to an existing approved staffing vendor. This process unburdens the hiring manager from having to manage the contracting and payroll onboarding tasks internally.

Hiring managers typically select companies they have a good existing working relationship with, resulting in simplified onboarding that speeds up the contingent worker hiring process. The trusted vendor has also likely been onboarded through the company’s procurement process, and already has all necessary legal agreements in place and meets jurisdiction-specific compliance requirements such as valid business licenses, tax remittance capabilities, pay schedules, employee categories, or a particular aspect of payroll calculations (insurance, workers’ compensation, etc.).

Though this model is generally faster and easier for hiring managers, it is difficult for the company to track and manage its corporate spending of directly-sourced contingent labour. Likewise, the use of multiple staffing vendors results in legal and compliance inconsistency between contingent labour engagements, as well as service levels and individual worker management.

The company typically does not use structured pricing models or pay rates. Additionally, using multiple vendors results in difficulty negotiating high-volume flat and/or preferred fees for the hiring process, resulting in the potential for abusive vendor pricing.

Single, Dedicated Payroller

This model involves a single outsourced service provider responsible for managing a company’s entire payroll record keeping process across all jurisdictions where that company employs personnel. It represents the company’s decision to treat contingent labour hiring and management as a corporate priority, and offers benefits around streamlining operations, enforcement of established spend approval processes, consistency in record keeping through a single vendor, and securing the lowest possible price for the service.

It also lowers a company’s risk by incorporating a single point of accountability and audit for all of the compliance activities related to contingent worker onboarding and management, and decreases the likelihood of overlooked short-term, contract or seasonal workforce records and improper worker classification. This model can be especially advantageous for employers who may operate in multiple domestic or international jurisdictions.

RFP Checklist for pre-identified contractor payroll vendor selection

Are you getting the most out of your contractor payroll program? Every organization’s needs are different, but there are several crucial elements to keep in mind when evaluating a contractor payroll program. These include:

- Infrastructure and expertise

- Worker management

- Onboarding

- Rate management

However, there are other, less obvious criteria that still make a big difference in cost, compliance and satisfaction.

If you’re evaluating a new contractor payroll provider or would like a tool for assessing whether you’re getting the most out of your current program, download your detailed RFP Checklist for pre-identified payroll vendor selection below: